How Medicare Supplement Can Boost Your Insurance Coverage Coverage Today

As people navigate the details of healthcare plans and seek thorough protection, understanding the nuances of additional insurance coverage ends up being significantly crucial. With a focus on bridging the gaps left by traditional Medicare plans, these supplemental options offer a tailored approach to meeting specific needs.

The Essentials of Medicare Supplements

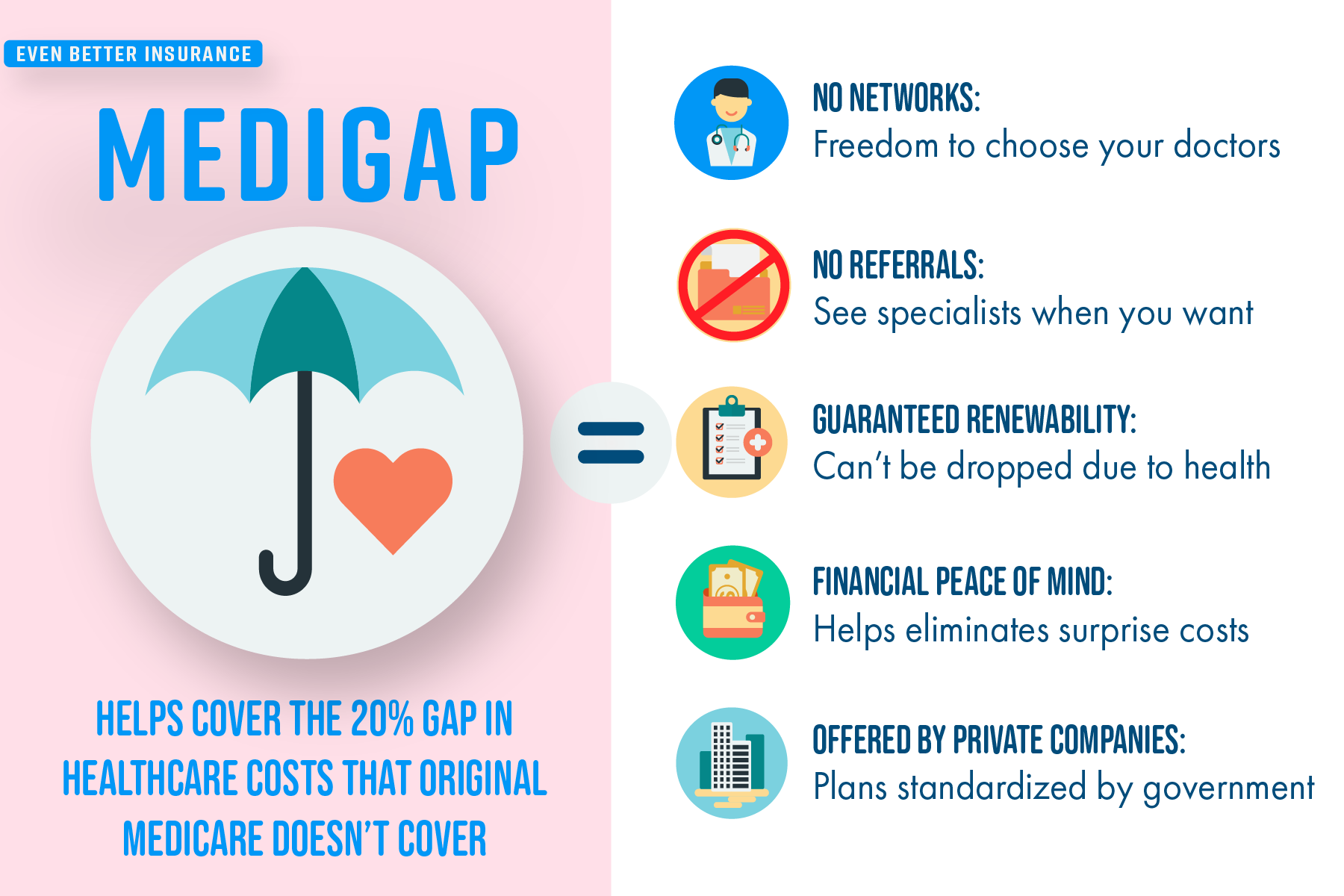

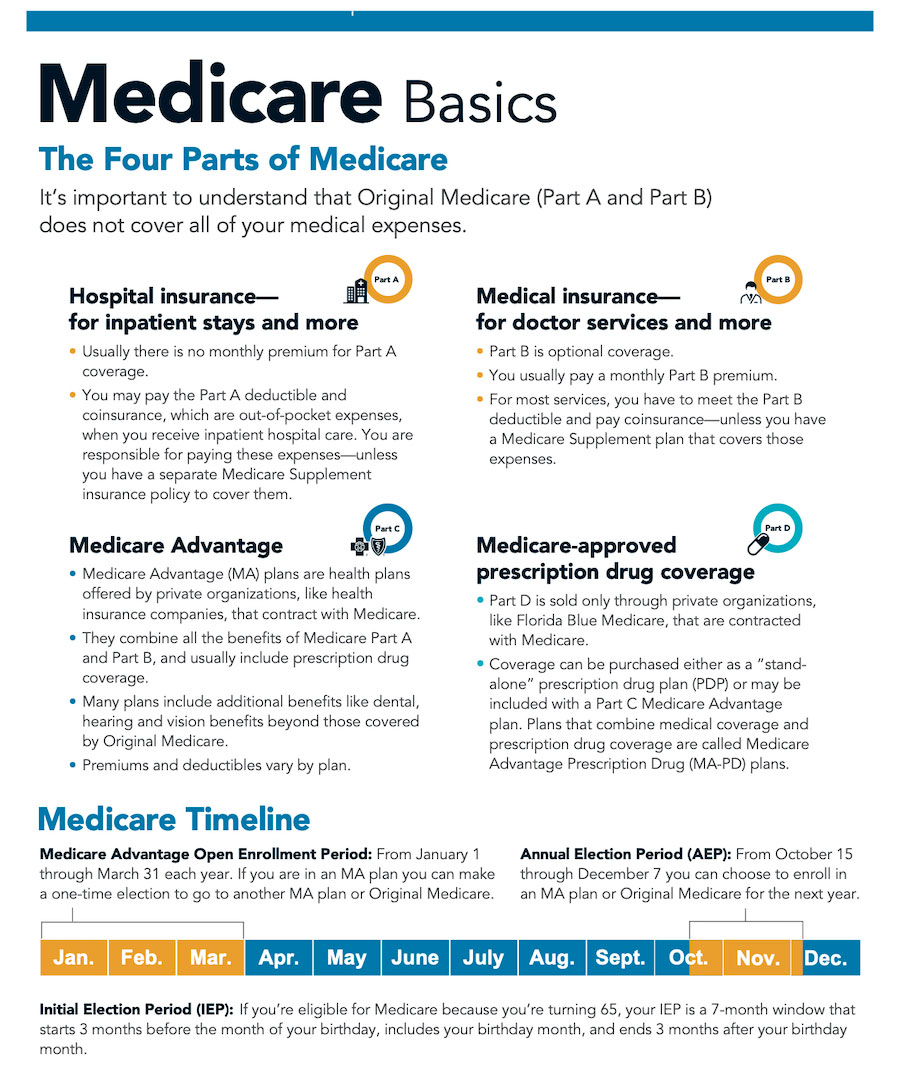

Medicare supplements, also understood as Medigap strategies, offer added coverage to fill the spaces left by initial Medicare. These additional strategies are used by personal insurer and are created to cover expenditures such as copayments, coinsurance, and deductibles that are not fully covered by Medicare Part A and Part B. It's vital to note that Medigap plans can not be utilized as standalone plans yet job alongside original Medicare.

One key element of Medicare supplements is that they are standard throughout most states, providing the exact same fundamental benefits no matter of the insurance policy provider. There are ten different Medigap plans labeled A through N, each offering a different level of protection. Strategy F is one of the most detailed choices, covering nearly all out-of-pocket expenses, while other plans might supply extra minimal insurance coverage at a lower premium.

Understanding the basics of Medicare supplements is crucial for people approaching Medicare eligibility who want to enhance their insurance policy protection and minimize potential financial burdens associated with medical care costs.

Comprehending Coverage Options

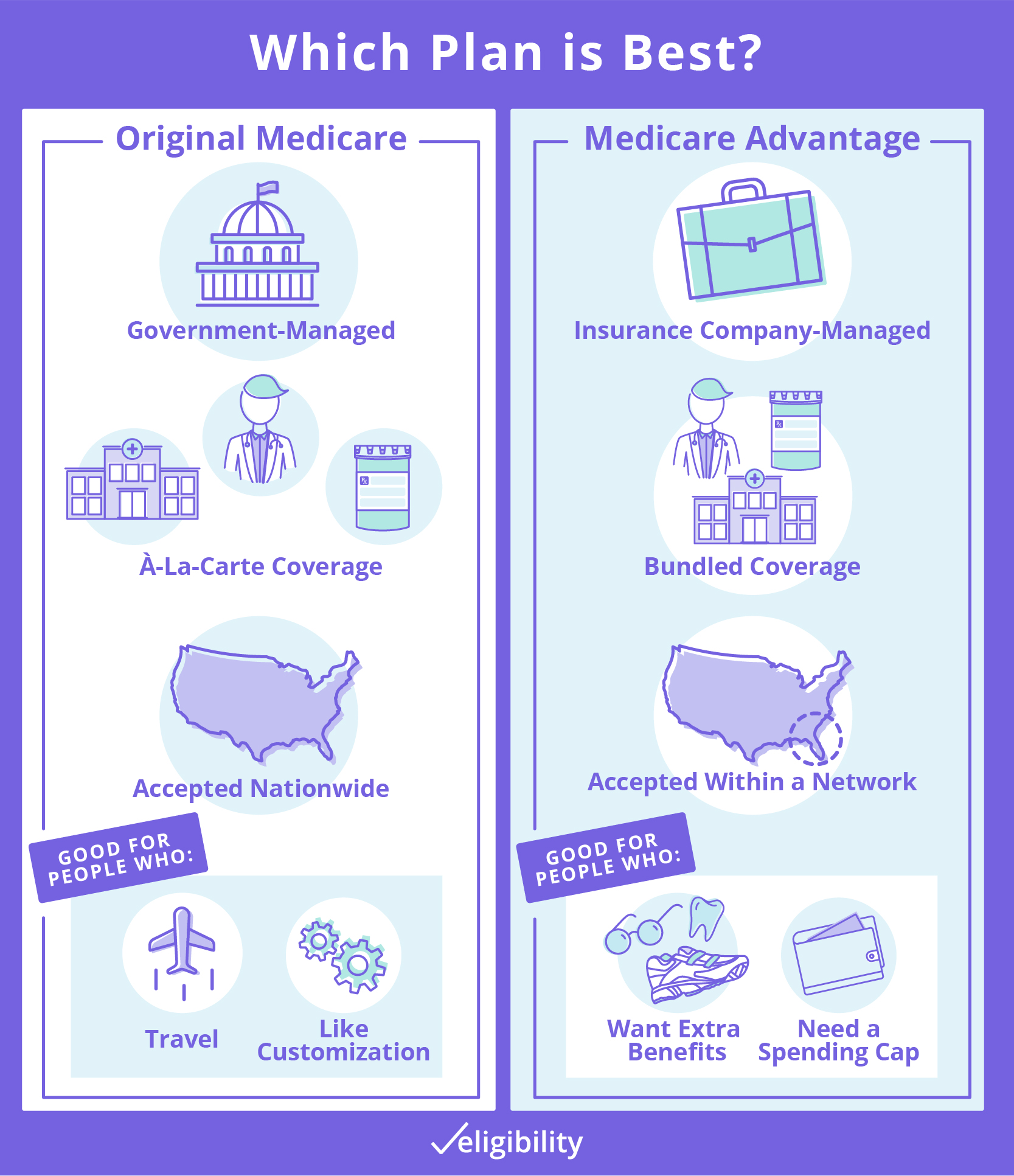

When taking into consideration Medicare Supplement intends, it is critical to understand the various insurance coverage alternatives to make sure detailed insurance coverage security. Medicare Supplement plans, also understood as Medigap policies, are standard throughout most states and classified with letters from A to N, each offering differing levels of insurance coverage - Medicare Supplement plans near me. In addition, some plans may offer insurance coverage for services not included in Initial Medicare, such as emergency situation treatment during international traveling.

Benefits of Supplemental Program

Comprehending the considerable advantages of additional plans can brighten the worth they bring to people seeking enhanced medical care protection. One key advantage of supplementary strategies is the financial safety they offer by aiding to cover out-of-pocket expenses that original Medicare does not totally pay for, such as deductibles, copayments, and coinsurance. This can cause considerable savings for insurance holders, particularly those who require constant medical solutions or treatments. In addition, additional strategies provide a more comprehensive series of protection alternatives, including accessibility to healthcare carriers that may not approve Medicare assignment. This adaptability can be essential for people who have certain medical care needs or like certain physicians or professionals. One more benefit of supplemental plans is the capability to take a trip with assurance, as some plans use protection for emergency medical solutions while abroad. Overall, the benefits of additional strategies add to an extra comprehensive and tailored technique to medical care coverage, guaranteeing that individuals can get the treatment they need without facing overwhelming monetary problems.

Price Factors To Consider and Cost Savings

Given the financial security and more comprehensive insurance coverage choices offered by additional plans, an essential facet to take into consideration is the expense considerations and potential savings they supply. While Medicare Supplement prepares require a month-to-month premium in addition to the standard Medicare Component B premium, the benefits of lowered out-of-pocket expenses frequently surpass the added expense. When reviewing the expense of supplemental strategies, it is necessary to compare costs, deductibles, more information copayments, and coinsurance across various plan kinds to determine one of the most economical option based upon individual health care needs.

By selecting a Medicare Supplement plan that covers a higher portion of health care expenditures, people can decrease unexpected costs and budget plan a lot more properly for clinical treatment. Inevitably, spending in a Medicare Supplement strategy can use useful economic defense and tranquility of mind for recipients looking for thorough insurance coverage.

Making the Right Selection

With a range of plans readily available, it is important to assess variables such as coverage alternatives, premiums, out-of-pocket prices, supplier networks, and overall worth. Additionally, reviewing your budget plan restraints and contrasting premium costs amongst various plans can aid guarantee that you pick a plan that is budget friendly in the lengthy term.

Conclusion